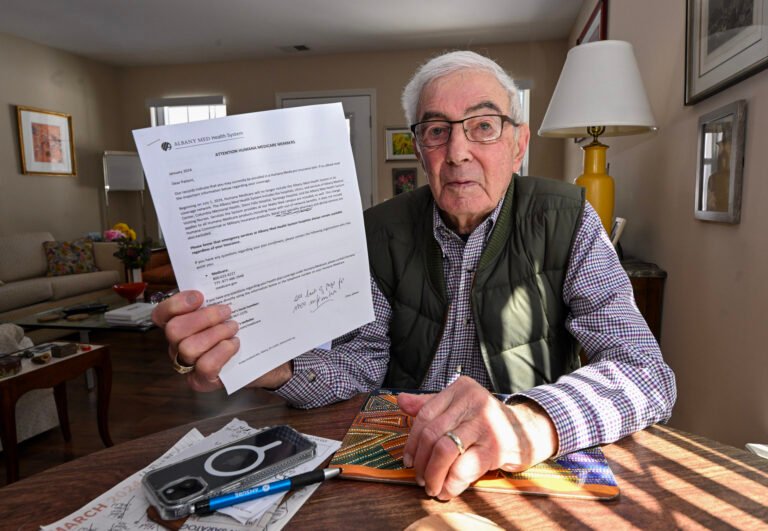

Bart Klion, 95, and his spouse, Barbara, confronted a tricky selection in January: The upstate New York couple discovered that this 12 months they might maintain both their non-public, Medicare Benefit insurance coverage plan — or their docs at Saratoga Hospital.

The Albany Medical Middle system, which incorporates their hospital, is leaving the Klions’ Humana plan — or, relying on which facet is speaking, the opposite method round. The breakup threatened to chop the couple’s lifeline to deal with severe continual well being situations.

Klion refused to select the lesser of two unhealthy choices with out a struggle.

He contacted Humana, the Saratoga hospital, and the well being system. The couple’s docs “are an distinctive group of caregivers and have made it potential for us to reside an lively and productive life,” he wrote to the hospital’s CEO. He referred to as his spouse’s former employer, which requires its retirees to enroll in a Humana Medicare Benefit plan to obtain firm well being advantages. He additionally contacted the New York StateWide Senior Action Council, one of many nationwide State Well being Insurance coverage Help Packages that offer free, unbiased advice on Medicare.

Klion stated all of them informed him the identical factor: Maintain your docs or your insurance coverage.

With rare exceptions, Benefit members are locked into their plans for the remainder of the 12 months — whereas well being suppliers could depart at any time.

Disputes between insurers and suppliers can result in total hospital methods all of a sudden leaving the plans. Insurers should adjust to intensive rules from the Facilities for Medicare & Medicaid Providers, together with little-known protections for beneficiaries when docs or hospitals depart their networks. However the information of a breakup can come as a shock.

Within the almost three many years since Congress created a private-sector different to unique, government-run Medicare, the plans have enrolled a file 52% of Medicare’s 66 million older or disabled adults, in keeping with the CMS. However together with getting extra benefits that unique Medicare doesn’t supply, Benefit beneficiaries have found downsides. One frequent grievance is the requirement that they obtain care solely from networks of designated suppliers.

Many hospitals have additionally turn out to be disillusioned by this system.

“We hear on daily basis, from our hospitals and well being methods throughout the nation, about challenges they expertise with Medicare Benefit plans,” stated Michelle Millerick, senior affiliate director for medical health insurance and protection coverage on the American Hospital Affiliation, which represents about 5,000 hospitals. The hurdles embody prior authorization restrictions, late or low funds, and “inappropriate denials of medically obligatory coated providers,” she stated.

“A few of these points get to a boiling level the place selections are made to not take part in networks anymore,” she stated.

An Escape Hatch

CMS offers most Benefit members two possibilities to vary plans: through the annual open enrollment interval within the fall and from January till March 31.

However just a few years in the past, CMS created an escape hatch by increasing special enrollment periods, or SEPs, which permit for “distinctive circumstances.” Beneficiaries who qualify can request SEPs to vary plans or return to unique Medicare.

Based on CMS guidelines, there’s an SEP sufferers could use if their well being is in jeopardy on account of issues getting or persevering with care. This may occasionally embody conditions wherein their well being care suppliers are leaving their plans’ networks, stated David Lipschutz, an affiliate director on the Center for Medicare Advocacy.

One other SEP is on the market for beneficiaries who expertise “vital” community adjustments, though CMS officers declined to elucidate what qualifies as vital. Nonetheless, in 2014, CMS offered this SEP to UnitedHealthcare Benefit members after the insurer terminated contracts with suppliers in 10 states.

When suppliers depart, CMS ensures that the plans preserve “satisfactory entry to wanted providers,” Meena Seshamani, CMS deputy administrator and director of the federal Middle for Medicare, stated in a press release.

Whereas hospitals say insurers are pushing them out, insurers blame hospitals for the turmoil in Medicare Benefit networks.

“Hospitals are utilizing their dominant market positions to demand unprecedented double-digit fee will increase and threatening to terminate their contracts if insurers don’t agree,” stated Ashley Bach, a spokesperson for Regence BlueShield, which presents Benefit plans in Idaho, Oregon, Utah, and Washington state.

Sufferers get caught within the center.

“It feels just like the powers that be are enjoying hen,” stated Mary Kay Taylor, 69, who lives close to Tacoma, Washington. Regence BlueShield was in a weeks-long dispute with MultiCare, one of many largest medical methods within the state, the place she will get her care.

“These of us that want this care and protection are actually inconsequential to them,” she stated. “We’re left in limbo and uncertainty.”

Different breakups this 12 months embody Baton Rouge Common hospital in Louisiana leaving Aetna’s Medicare Benefit plans and Baptist Well being in Kentucky leaving UnitedHealthcare and Wellcare Benefit plans. In San Diego, Scripps Well being has left almost all the world’s Benefit plans.

In North Carolina, UNC Well being and UnitedHealthcare renewed their contract simply three days earlier than it could have expired, and solely two days earlier than the deadline for Benefit members to change plans. And in New York Metropolis, Aetna told its Advantage members this 12 months to be ready to lose entry to the 18 hospitals and different care amenities within the NewYork-Presbyterian Weill Cornell Medical Middle well being system, earlier than reaching an settlement on a contract final week.

Restricted Decisions

Taylor didn’t need to lose her docs or her Regence Benefit plan. She’s recovering from surgical procedure and stated ready to see how the drama would finish “was actually scary.”

So, final month, she enrolled in one other plan, with assist from Tim Smolen, director of Washington’s SHIP, Statewide Well being Insurance coverage Advantages Advisors program. Quickly afterward, Regence and MultiCare agreed to a brand new contract. However Taylor is allowed just one change earlier than March 31 and may’t return to Regence this 12 months, Smolen stated.

Discovering another plan may be like profitable at bingo. Some sufferers have a number of docs, who all should be simple to get to and coated by the brand new plan. To keep away from greater, out-of-network payments, they need to discover a plan that additionally covers their prescribed drugs and consists of their most well-liked pharmacies.

“Lots of instances, we could get via the supplier community and discover that that’s good to go however then we get to the medicine,” stated Kelli Jo Greiner, state director of Minnesota’s SHIP, Senior LinkAge Line. Since Jan. 1, counselors there have helped greater than 900 individuals change to new Benefit plans after HealthPartners, a big well being system based mostly in Bloomington, left Humana’s Medicare Benefit plans.

Decisions are extra restricted for low-income beneficiaries who obtain subsidies for medicine and month-to-month premiums, which only a few plans accept, Greiner stated.

For almost 6 million people, a former employer chooses a Medicare Advantage plan and requires them to enroll in it to obtain retiree well being advantages. In the event that they need to maintain a supplier who leaves that plan, these beneficiaries should forfeit all their employer-subsidized well being advantages, usually together with protection for his or her households.

The specter of shedding protection for his or her suppliers was one purpose some New York Metropolis retirees sued Mayor Eric Adams to cease efforts to drive 250,000 of them into an Aetna Benefit plan, stated Marianne Pizzitola, president of the New York Metropolis Organization of Public Service Retirees, which filed the lawsuit. The retirees received thrice, and metropolis officers are interesting once more.

CMS requires Benefit plans to inform their members 45 days earlier than a main care physician leaves their plan and 30 days earlier than a specialist doctor drops out. However counselors who advise Medicare beneficiaries say the discover doesn’t all the time work.

“Lots of people are experiencing disruptions to their care,” stated Sophie Exdell, a program supervisor in San Diego for California’s SHIP, the Well being Insurance coverage Counseling & Advocacy Program. She stated about 32,000 individuals in San Diego misplaced entry to Scripps Well being suppliers when the system left a lot of the space’s Benefit plans. Many didn’t get the discover or, in the event that they did, “they couldn’t get via to somebody to get assist making a change,” she stated.

CMS additionally requires plans to adjust to community adequacy guidelines, which restrict how far and the way lengthy members should journey to main care docs, specialists, hospitals, and different suppliers. The company checks compliance each three years or extra usually if obligatory.

In the long run, Bart Klion stated he had no different however to stay with Humana as a result of he and his spouse couldn’t afford to surrender their retiree well being advantages. He was capable of finding docs keen to tackle new sufferers this 12 months.

However he wonders: “What occurs in 2025?”