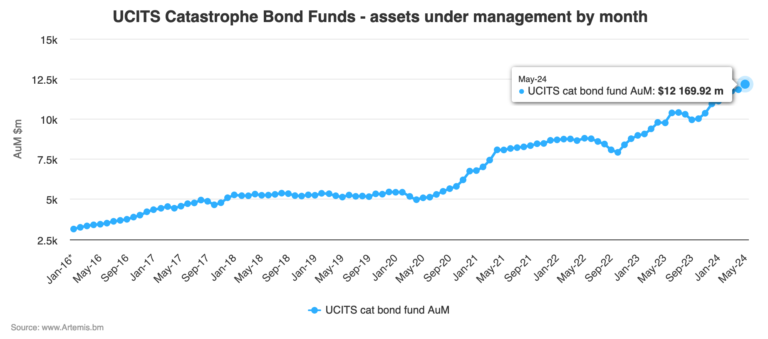

The mixed property beneath administration of the principle disaster bond funds within the UCITS format have now surpassed $12 billion for the primary time ever, nearing $12.2 billion by the top of Might 2024 and now having risen by over 11% to date this 12 months.

Disaster bond funds within the UCITS format have skilled robust progress during the last 12 months, with their mixed cat bond property beneath administration (AUM) now up by 25% during the last twelve months.

The bigger cat bond funds proceed to paved the way, with the three largest UCITS cat bond fund methods contributing $8.7 billion of the full, or 72% of the full property beneath administration throughout the group of 16 UCITS cat bond funds.

Whereas the group of the three largest cat bond funds has not grown on the similar tempo as the general, this is because of Fermat Capital Management having launched its own-branded UCITS cat bond fund strategy this year, which has been rising strongly.

Notably, the UCITS cat bond fund sector solely hit the $11 billion AUM milestone in January and so has now surpassed the following $12 billion milestone in lower than 5 months.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

By the top of Might 2024, the UCITS cat bond fund that has added essentially the most in property to date this 12 months is Fermat Capital Administration’s new Fermat UCITS Cat Bond Fund, which has grown to virtually $541 million from its launch in January.

However, on the similar time, the GAM Star Cat Bond Fund, which is portfolio managed by Fermat, misplaced $275 million to date this 12 months, of which a big quantity is prone to have flowed to Fermat’s new own-branded cat bond fund technique.

Of the established UCITS cat bond funds, the Schroder GAIA Cat Bond Fund has added $461 million in property via the primary 5 months of 2024, so is the quicker grower.

The Leadenhall Capital Companions managed Leadenhall UCITS ILS Fund is subsequent, having added virtually $287 million in property this 12 months.

The current launched Icosa Cat Bond Fund can also be a notable addition, having added over $126 million in property since its launch at first of the 12 months.

The biggest UCITS cat bond fund on the finish of Might 2024 was the Schroder GAIA technique, at approaching $3.3 billion, adopted by the Twelve Capital Cat Bond Fund at $2.94 billion and the GAM Star Cat Bond Fund at $2.47 billion, then Leadenhall’s cat bond technique at virtually $900 million in dimension.

Notably, UCITS cat bond fund property beneath administration have now risen by round 39% for the reason that finish of 2022 and UCITS cat bond funds as a bunch now maintain greater than double the property that they had beneath their administration as not too long ago as Q3 2020.

With the catastrophe bond market pipeline nonetheless lively even with the wind season approaching and the cat bond market yield nonetheless at a traditionally excessive degree, we anticipate additional AUM progress for the group of UCITS cat bond funds as soon as information is obtainable for the total first-half of this 12 months.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can too analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.