The growing frequency and severity of claims prices past insurer expectations proceed to threaten insurance coverage protection and affordability. Triple-I’s newest Subject Temporary, Legal System Abuse – State of the Risk describes how traits in claims litigation can drive social inflation, resulting in greater insurance coverage premiums for policyholders and losses for insurers.

Key Takeaways

- Insured losses proceed to exceed expectations and surpass inflation, notably impacting protection affordability and availability in Florida and Louisiana.

- In selling the time period “authorized system abuse”, Triple-I seeks to seize how litigation and associated systemic traits amplify social inflation.

- Progress has been made towards elevated consciousness concerning the dangers of third-party litigation funding (TPLF), however extra work is required.

What we imply after we speak about authorized system abuse

Authorized system abuse happens when policyholders, plaintiff attorneys, or different third events use fraudulent or pointless techniques in pursuing an insurance coverage declare payout, growing the time and price of settling insurance coverage claims. These actions can embrace unlawful maneuvers, similar to claims inflation and frivolous or outright fraudulent claims. Unscrupulous contractors, for instance, search to revenue from Project of Advantages (AOBs) by overstating restore prices after which submitting lawsuits in opposition to the insurer – generally even with out the home-owner’s information. Submitting a lawsuit to reap an outsized payout when it’s evident the claims course of will doubtless present a good, affordable, and well timed declare settlement may also be thought of authorized system abuse.

The newest transient supplies a round-up of a number of research Triple-I and different organizations carried out on components of those litigation traits. The report, “Influence of Growing Inflation on Private and Industrial Auto Legal responsibility Insurance coverage,” describes the $96 billion to $105 billion improve in mixed declare payouts for U.S. private and business auto insurer legal responsibility. The Insurance coverage Analysis Council highlighted the dire lack of affordability for private auto and owners insurance coverage protection in Louisiana, together with the state’s exceptionally excessive declare litigation charges.

Readers can even discover an replace on the dialogue of authorized trade traits related to elevated claims litigation. The dearth of transparency round TPLF preparations and the worry of outdoor affect on circumstances are attracting the eye of legislators on the state and federal ranges. The transient additionally describes how some legislation companies could use TPLF assets to encourage giant windfall-seeking lawsuits as a substitute of speedy and honest claims litigation. Analysis findings recommend that buyers have turn into conscious of how ubiquitous lawyer advertisements can affect the frequency of lawsuits, growing claims prices.

Florida: a case examine within the penalties of extreme litigation

Whereas a number of states, similar to California, Colorado, and Louisiana, are experiencing a drastic rise in the price of owners’ insurance coverage, this transient discusses Florida. Property insurance coverage premiums there rank the best within the nation. A number of insurers going through insurmountable losses have stopped writing new insurance policies or left the state in the previous few years. In some areas, residents are leaving, too, due to skyrocketing premiums.

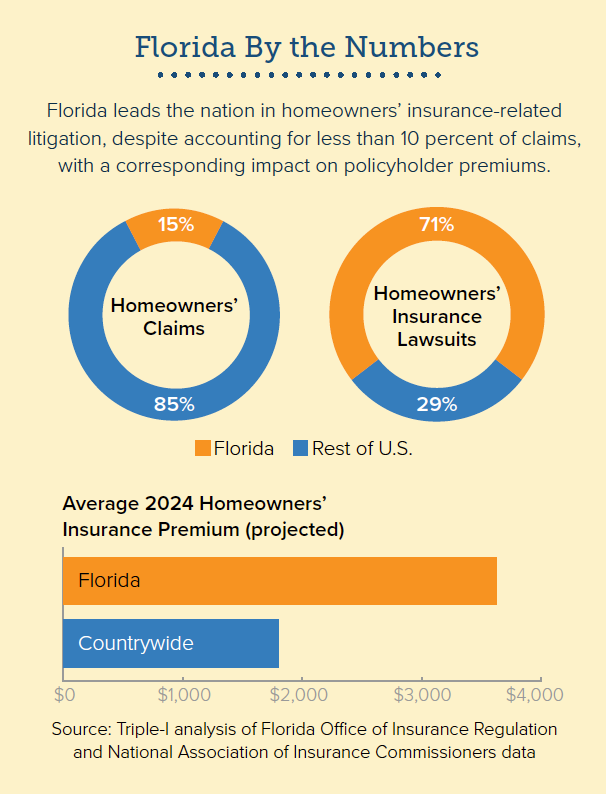

Extreme claims litigation isn’t a brand new difficulty for insurers, however it might probably work with different components to shift loss ratios and disrupt forecasts, rendering value administration tougher. In Florida, elements such because the rise in dwelling values and frequency of utmost climate occasions play a big position, together with the challenges owners face within the aftermath: hovering development prices, provide chain bottlenecks, and new constructing codes. Nevertheless, Florida additionally leads the nation in litigating property claims. Whereas 15 p.c of all owners claims within the nation originate within the state, Floridians file 71 p.c of householders insurance coverage lawsuits.

In Florida and elsewhere, growing time to settle a declare places a monetary pressure on insurers, which is handed on to policyholders within the type of greater premiums. Authorized system abuse actions are troublesome (if not not possible) to forecast and mitigate, hampering insurers’ skill to stay available in the market. Subsequently, authorized system abuse could possibly be one of many largest underlying drivers of social inflation. With out preventive measures, similar to coverage intervention and elevated policyholder consciousness, protection affordability and availability is in danger.

Triple-I remains committed to advancing the dialog and exploring actionable methods with all stakeholders. Be taught extra about authorized system abuse and its parts, similar to third-party litigation funding by following our weblog and testing our social inflation knowledge hub.