Private and non-private insurance coverage market losses from all perils related to hurricane Helene “will seemingly attain at the least into the upper single-digit billions,” in accordance with Aon’s Affect Forecasting division.

The corporate stated that complete financial losses will probably be notably increased and likewise famous that hurricane Helene has now develop into one of many deadliest in US historical past, with 215 deaths now reported.

“Damaging wind gusts broken properties from northern Florida to the Carolinas. Notably, a 1-in-1000-year rainfall occasion occurred over western North Carolina, inflicting catastrophic flooding and excessive devastation for dozens of close by communities,” Aon’s Affect Forecasting workforce defined.

The corporate additional defined, “Helene’s very giant and highly effective wind subject, intense storm surge, and catastrophic inland flooding will end in important monetary implications for a lot of the southeast United States. As of September 30, over 40,000 claims have already been filed in Florida, in accordance with Florida’s Workplace of Insurance coverage Regulation.

Throughout all of the affected states and together with all of the perils which have resulted in monetary damages, Aon is anticipating hurricane Helene’s business loss to be the costliest world disaster loss occasion of the yr up to now for the market, it appears.

“Whole non-public and public insured losses from wind, surge, and flood impacts will seemingly attain at the least into the upper single-digit billions,” the corporate stated.

Which could recommend Aon’s Affect Forecasting sees an opportunity that the mixed non-public insurance coverage market and NFIP loss will attain into the double-digits, which does appear potential now we’ve private market estimates pointing to the mid-to-high single-digit billions alone.

Including, “Nonetheless, areas within the southern Appalachian Mountains that noticed catastrophic flooding harm additionally exhibit low private and non-private flood insurance coverage take-up charges, suggesting a pretty big insurance coverage hole. In consequence, financial losses will probably be notably increased.

Nationwide Flood Insurance coverage Program (NFIP) losses are being talked about within the $3 billion to $5 billion vary by our sources, so it’s not a stretch to think about the mixed non-public and public insured loss tally surpassing $10 billion.

Additionally learn:

– Some nerves evident as Helene’s Florida claims outpace Idalia, State Farm’s outpace Ian, & on NFIP.

– Hurricane Helene insurance industry loss estimated close to $6.4bn by KCC.

– Direct cat bond losses still seen unlikely from Helene, but NFIP bonds monitored: Twelve Capital.

– Hurricane Helene floods over 100k buildings, at least 10k to over 5 feet: ICEYE.

– Hurricane Helene insured losses anywhere from mid-single to even double-digit billions: RBC.

– Florida reinsurance dependency in focus after Helene, with $5bn+ loss expected: AM Best.

– FEMA’s NFIP reinsurance & cat bonds in focus after catastrophic flooding from Helene.

– Hurricane Helene private insurance loss seen mid-to-high single-digit billions: Bowen, Gallagher Re.

– Hurricane Helene economic loss in $20bn – $34bn range: Moody’s Analytics.

– Hurricane Helene insured wind/surge property loss in Florida/Georgia initially said $3bn – $5bn: CoreLogic.

– Losses to per-occurrence cat bonds from hurricane Helene currently seen as unlikely: Twelve Capital.

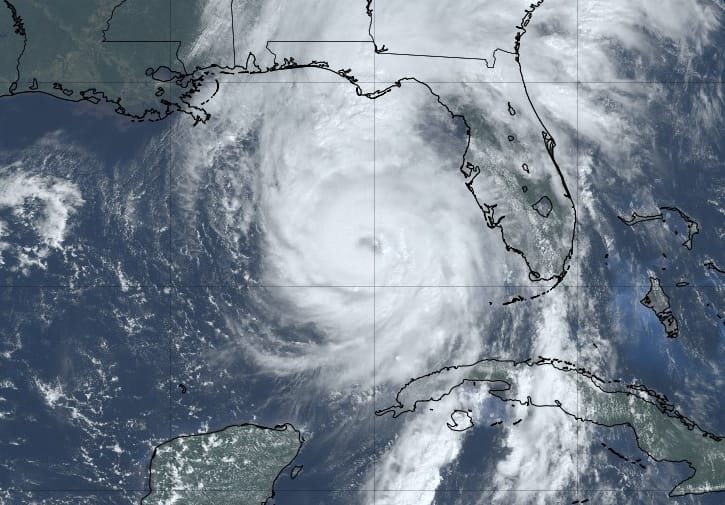

– Hurricane Helene landfall at Cat 4 140mph winds, Tampa Bay sees historic surge flooding.

– Hurricane Helene industry loss seen $3bn to $6bn if Tampa avoided: Gallagher Re.

– Minimal to no cat bond impact expected from hurricane Helene if track unchanged: Plenum.