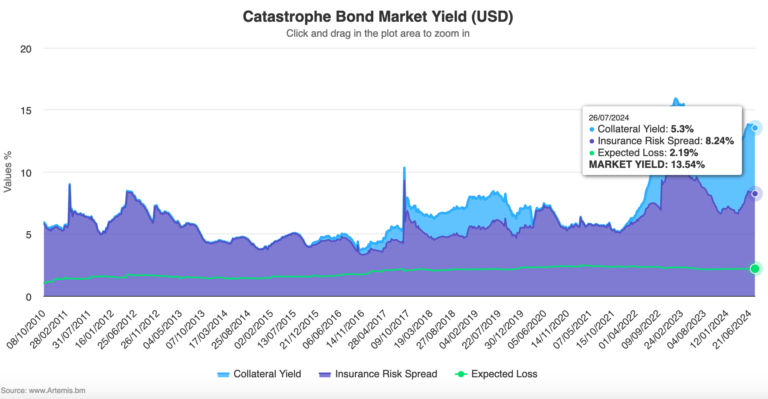

Seasonality has began to change into seen within the general yield of the disaster bond market, with the determine sliding barely within the month of July 2024 to finish the interval at a nonetheless traditionally very excessive 13.54%.

2024 has seen the disaster bond market yield on extra of a curler coaster than regular, with unfold tightening to start the yr, which drove cat bond spreads and yields down, which was adopted by a interval of comparatively important unfold widening that drove the market yield again up once more.

Having reached an all-time excessive of round 15.91% in early 2023, the cat bond market skilled a variety tightening development that noticed the cat bond market yield bottoming out at slightly below 12% by the top of March 2024.

A rising contribution from insurance coverage threat spreads then drove the cat bond market yield again as much as as excessive as 13.83% in early June, since when it has slowly tapered off to 13.69% by the top of June and persevering with right down to 13.54% by the top of July 2024.

The newest decline is seen as largely resulting from seasonal results which can be typical with disaster bonds because the Atlantic hurricane season ramps up in direction of its typical peak.

You possibly can analyse these market yield developments in our chart that displays the yield of the catastrophe bond market over time.

As anticipated, it’s the insurance coverage threat unfold element that has declined in July, falling from 8.41% at the start of the month to finish it at 8.24%.

The floating-rate attraction of disaster bond investments stays sturdy, with the typical collateral yield barely down at 5.3%, combining to provide the general cat bond market yield of 13.54% on the finish of July.

As we reported yesterday, the rolling twelve-month performance of UCITS catastrophe bond funds as measured by Plenum’s Index, to August 2nd, was 11.74%.

Exhibiting that cat bond funds, on common, are monitoring the full market yield potential comparatively intently, delivering the elevated returns potential from cat bonds again to their traders.

Specialist disaster bond funding fund supervisor Plenum Investments stated that the yield of the disaster bond market stays very enticing, even together with hedging prices.

The general yield of the cat bond market sat at 11.90% in Euros and 9.33% in Swiss Francs on the finish of July 2024.

Trying again over historical past, the cat bond market yield stays excessive, comparatively, which ought to proceed to draw traders by means of the remainder of this yr and past.

Plenum Investments additionally famous that, “We anticipate CAT bond yields to proceed to say no because the US hurricane season progresses,” which is their typical seasonal behaviour.

Analyse catastrophe bond market yields over time using this chart.