Disaster bond new issuance continues apace in 2024 and has reached $12.1 billion together with the most recent offers to hit the market and settle at present, which suggests the tempo of issuance is now operating 29% forward of the prior yr, in accordance with the most recent knowledge from Artemis.

That fee of issuance is especially notable, particularly as final yr set a brand new disaster bond market issuance file for the first-half.

Actually, the cat bond market in 2024 is already greater than $1.8 billion forward of the first-half issuance file set a yr in the past, which was $10.3 billion.

In 2024, the disaster bond market has accelerated into the second-quarter, as would usually be anticipated, however then skilled a slight slowing in latest weeks, due to the spread developments we’ve reported extensively on.

This has slowed some sponsors down of their method to the cat bond market and even resulted within the cancellation of two issuances, the latest being the Gateway Re 2024-3 deal and previous to that Ariel Re’s latest cat bond.

However, even with these pricing developments and cancelled points, the cat bond market stays on-track to interrupt all data for the first-half of the yr in 2024.

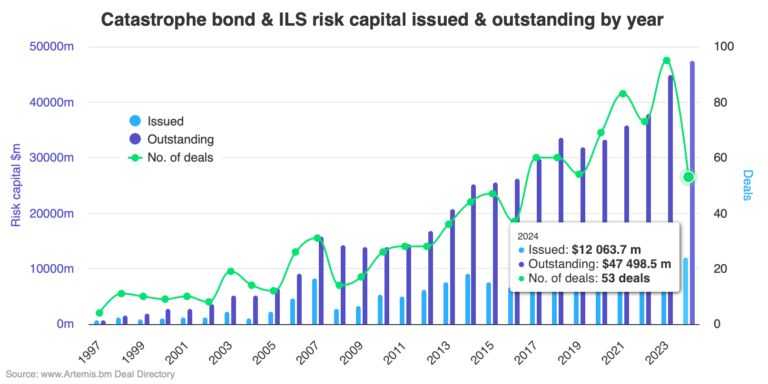

The chart beneath (available here in interactive form) reveals disaster bond issuance year-to-date and in addition market development:

With nearly $12.1 billion of settled new disaster bond issuance throughout 53 offers that we’ve tracked right here at Artemis, the tempo of issuance is now precisely 29% forward of the place the market sat on June twentieth 2023.

It’s value noting that the tempo has slowed because the finish of Might, as we had reported the cat bond market was running some 38% ahead of the prior year by the end of that month.

However final yr, June was a powerful month with $1.8 billion of issuance, the place as this June 2024 is about to be a lot slower than that, which we suspect might have one thing to do with the unfold developments seen available in the market, not less than to a level.

Presently final yr we’d tracked 50 new cat bond issuances in our Deal Directory, whereas for the complete half-year 2023 the full was 56 offers and $10.3 billion of issuance.

By the tip of this month, primarily based on what we all know of the cat bonds remaining available in the market and more likely to choose or earlier than June 3oth, the tip of first-half whole issuance for 2024 must be round $12.4 billion, from 57 offers tracked.

Which, in fact, means the typical deal measurement is about to be significantly greater for the first-half in 2024, helped enormously by a handful of bigger issuances this yr.

It’s additionally notable that final yr set a file for the second-quarter and it was the most important single quarter of cat bond issuance ever at $7.1 billion in Q2 2023.

However, in Q2 2024, we’ve already eclipsed that with greater than $7.8 billion issued up to now this yr and one other $300 million or extra nonetheless to settle.

So the disaster bond market has already damaged the first-half and second-quarter issuance data in 2024 and as soon as we analyse the info in additional element, we’re more likely to discover different data will break, as 2024 stays on-course to set new highs for disaster bond exercise on nearly each entrance.

Only a few years in the past, $12 billion of disaster bond issuance was seen as a wholesome full-year determine. Now it’s a brand new benchmark for a wholesome first-half of cat bond issuance and the milestones are set to maintain coming, as sponsors proceed to seek out the cat bond market a sexy place to supply their reinsurance and retrocession.

Lastly, at this stage of the yr, the excellent disaster bond market has solely grown by roughly 6%, regardless of the file ranges of issuance seen.

There are solely $50 million extra in maturities scheduled for this month, in accordance with Artemis’ knowledge, however market development is probably slower than might need been anticipated. Which reveals there may be not an enormous quantity of room for contemporary capital within the area, regardless of the robust new issuance, with recycling of money from maturities in a position to help the overwhelming majority of recent offers with none new inflows.

Outright development of the cat bond market could also be somewhat sooner within the second-half, if issuance retains tempo with expectations. Extra on that in our subsequent quarterly cat bond market report.

The Artemis Deal Directory lists all disaster bond and associated transactions accomplished because the market was fashioned within the late 1990’s. The listing additionally lists the cat bonds ready to settle, that are highlighted in inexperienced on the high of the record.

Download our free quarterly catastrophe bond market reports.

We observe catastrophe bond and related ILS issuance data, essentially the most prolific sponsors in the market, most energetic structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus a lot more.

Find all of our charts and data here, or by way of the Artemis Dashboard which supplies a useful one-page view of cat bond market metrics.

All of those charts and visualisations are up to date as quickly as a brand new cat bond issuance is accomplished, or as older issuances mature.