Issuance of latest disaster bonds and associated insurance-linked securities (ILS) has already reached $10.9 billion in 2024 and has now damaged the document for the first-half, whereas the quantity of cat bond and associated ILS threat capital excellent has reached one other new excessive because the market continues to develop.

The excellent marketplace for disaster bonds and associated insurance-linked securities (ILS) has now grown by greater than 8% thus far in 2024, reaching over $48.7 billion, based mostly on knowledge from Artemis’ Deal Directory and our vary of interactive cat bond market charts.

Issuance year-to-date has now reached $10.9 billion, due to the settlement of the most recent disaster bond from Florida Residents later immediately.

That determine will surpass $11 billion later this week and threat capital excellent will attain a landmark of greater than $49 billion in consequence.

The earlier half-year document was $10.3 billion set in 2023, so we’re now effectively previous that and the disaster bond market is on-track to set a really excessive H1 benchmark determine in 2024.

The expansion of the disaster bond market and associated ILS is driving vital alternative for traders to deploy capital, with cat bond fund managers capable of elevate new funds and deploy money earned from the sturdy returns the market has been producing.

Whereas we’ve seen some fluctuations in value and unfold volatility, issues do stay comparatively balanced with final yr, Artemis’ knowledge reveals.

First, issuance yr to-date, of which notable data set thus far embody the very fact we’re now forward of another first-half and likewise the truth that the cat bond issuance determine for the primary 5 months of the yr is now over $2.3 billion forward of final yr and eclipses another yr in Artemis’ knowledge set.

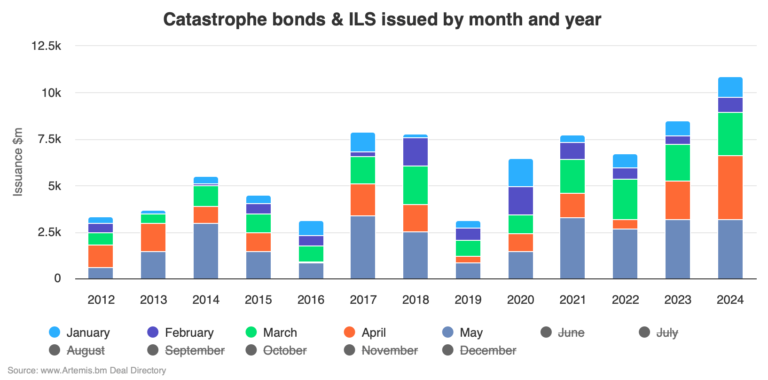

The chart under (and accessible here in interactive form) reveals simply January by way of Might disaster bond issuance and you’ll see that 2024 is outpacing all different years considerably. You need to use this chart to analyse issuance by month and yr, by deselecting months you need to embody knowledge for.

Subsequent, we are able to check out the varieties of offers making up the document $10.9 billion of latest cat bonds and associated ILS which have settled in 2024 as of immediately.

It’s made up of $10.34 billion of 144A property disaster bonds, which notable is already the fourth highest issuance for any full-year of that core part of the cat bond market.

On prime of this, Artemis has thus far this yr tracked $360 million of 144A cat bonds masking different traces of enterprise (cyber and well being dangers), in addition to nearly $173 million of personal cat bonds (cat bond lites).

Analyse this knowledge utilizing the chart under (accessible here in interactive form).

Transferring on to the quantity of threat capital excellent within the disaster bond market presently, the whole has grown 8% this yr already to achieve $48.7 billion and can surpass $49 billion later this week.

You’ll be able to see the expansion in cat bond threat capital excellent and cat bond market measurement over time utilizing the chart under (interactive version accessible here).

Everyone knows that pricing is a key consideration and concern for some, after the speedy unfold tightening that had been seen in disaster bonds earlier this yr.

More moderen unfold widening and better costs seen in new cat bond points does appear to be balancing issues out considerably, though whether or not that’s sustained longer-term stays to be seen.

Nevertheless, our interactive chart showing the average expected loss, spread and margin above expected loss, reveals that issues are comparatively steady, though the extent of threat being assumed, in EL phrases, is up barely, particularly in current quarters (view the same data by quarter here).

The upper anticipated loss being seen throughout points, whereas the typical unfold is definitely a little bit larger over time cat bonds thus far in contrast with 2023, implies that the multiple-at-market of catastrophe bonds issued has dropped, however the common for 2024 thus far stays for a variety a number of of greater than 4 instances the anticipated loss (as seen in this interactive chart, which once more it’s also possible to analyse by quarter here).

Lastly, as 2024 disaster bond issuance races forward of all data, it’s additionally notable that, in this chart, we present that cat bond issuance in 2024 is already the sixth highest annual complete ever, and we’re nonetheless in month 5 of the yr.

The way in which the market goes it is going to eclipse first-half data, with already greater than $11.8 billion of cat bonds anticipated as soon as every thing we have now in our Deal Directory has settled and doubtlessly some extra so as to add to that as effectively.

The upper the first-half document, the extra seemingly a full-year cat bond issuance document can be set and the magic $20 billion determine is no doubt in attain of the market in 2024.

The Artemis Deal Directory lists all disaster bond and associated transactions accomplished for the reason that market was shaped within the late 1990’s. The listing additionally lists the cat bonds ready to settle, that are highlighted in inexperienced on the prime of the record.

Download our free quarterly catastrophe bond market reports.

We observe catastrophe bond and related ILS issuance data, probably the most prolific sponsors in the market, most lively structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus a lot more.

Find all of our charts and data here, or through the Artemis Dashboard which offers a useful one-page view of cat bond market metrics.

All of those charts and visualisations are up to date as quickly as a brand new cat bond issuance is accomplished, or as older issuances mature.