Current unfold improvement within the disaster bond house has boosted the return potential of many cat bond funds, however for these traders that had extra concentrated publicity to industry-loss index set off cat bonds, the strikes have dented efficiency.

The disaster bond market has been on a comparatively wild journey, in terms of market spreads, ever since hurricane Ian in 2022.

A major rise in costs after that storm drove cat bond market insurance coverage danger spreads from slightly below 7% in September 2022 to a historic excessive of 11.31% in January 2023.

After that, cat bond danger spreads steadily tightened, which accelerated late final 12 months and continued into 2024, bottoming out in March at 6.62%.

Since when the market reversed its course to one in all unfold widening, driving the insurance coverage danger unfold of the cat bond market again as much as 8.13% as of the tip of Could 2024.

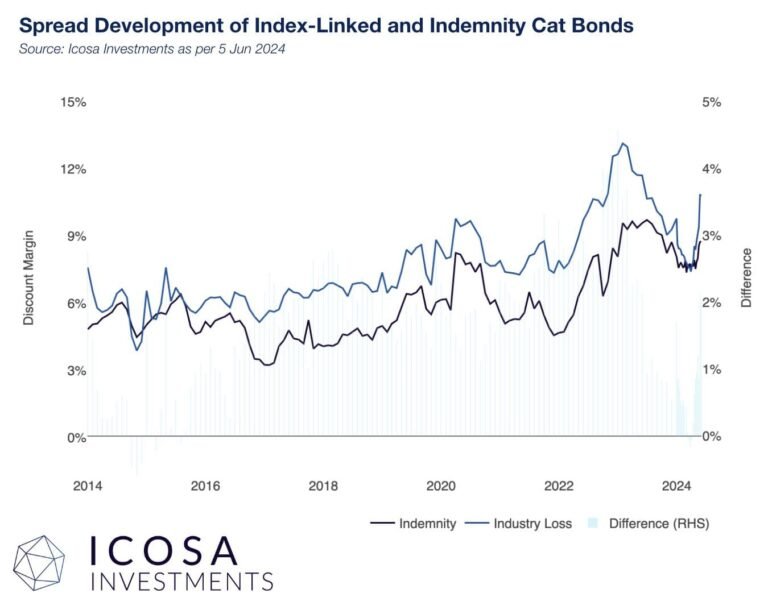

Index-trigger cat bonds led the way through the recent spread widening, as we’ve documented, however there was a normal enhance throughout indemnity cat bonds as effectively.

However, essentially the most pronounced unfold improvement was seen for the industry-loss index set off cat bond cohort, which have widened additional and sooner.

Numerous elements have pushed the event, together with the emergence of extra balanced provide and demand within the cat bond market, the effects a recent hurricane risk model update has had on investor and manager perception of risk, whereas some additionally cite the forecasts for an active hurricane season as an additional driver.

Zurich primarily based cat bond funding supervisor Icosa Investments has analysed the motion in index-trigger cat bonds vs indemnity, discovering the previous much more pronounced.

Icosa defined, “Three current index-linked transactions within the main market confronted inadequate demand, resulting in elevated pricing for 2 of these bonds and the cancellation of a 3rd issuance. Because of the excessive correlation inside the index-linked section, this triggered a direct repricing of almost all different index-linked cat bonds and a notable rise in spreads.”

The chart beneath from the funding supervisor exhibits how spreads have tracked for index cat bonds vs indemnity.

As you possibly can see in Icosa Funding’s chart above, the current unfold widening has returned the hole between the 2 classes of bonds.

By the newer tightening section, it appears index-trigger cat bonds tightened additional, closing the hole between the 2 classes utterly.

Then, the current unfold widening has reversed that development and the hole between the 2 has been restored.

Whereas there are clear causes for the market unfold improvement, it does appear a contributor might have been investor need to revive the delta between industry-loss and indemnity spreads, to a level.

The outcome, with spreads additionally widening for indemnity cat bonds, is an improved efficiency outlook for all cat bonds, with larger unfold returns obtainable.

Icosa Investments mentioned, “For traders, this improvement is constructive. Regardless of short-term mark-to-market losses, this adjustment enhances long-term return prospects and is more likely to entice extra capital into this asset class.”

Nevertheless, for these cat bond funds and portfolios that had been extra weighted in direction of industry-loss cat bonds, there was some brief time period ache due to the widening.

We perceive some cat bond funds have delivered adverse efficiency for Could, as a result of widening of industry-index set off cat bonds, with some methods down by over a proportion level for the month.

Which, as at all times, makes for a disappointing message to ship traders, particularly at a time when returns had been nonetheless driving excessive.

However, the repricing that has occurred will move by in efficiency phrases over future months, so it is going to be recovered and a few of that is counteracting the results of tightening that had maybe boosted cat bond fund returns, larger they’d usually have been with out that tightening section.

So finally, this all evens out over time and the short-term efficiency dent shouldn’t be a long-term indicator, with broader cat bond market return potential now a bit larger once more which can profit traders in all cat bond funds.