Florida’s Residents Property Insurance coverage Company, the insurer of final resort that’s currently in the catastrophe bond market with a new issuance that could approach $1.25 billion in size, is about to extend its price range for reinsurance and threat switch spend for 2024 to a most of $750 million.

Florida Residents is the residual market property insurance coverage provider for the state and buys one of many largest disaster reinsurance towers within the US.

For 2024, Florida Citizens is looking to buy its biggest reinsurance program ever for the coming 2024 hurricane season with a goal to safe $5.5 billion of safety from reinsurance and capital markets.

With the reinsurance market onerous and pricing remaining excessive for patrons of disaster threat safety, Florida Residents price range to safe this system has now been elevated to a $750 million most.

Again in December, when we had covered a Citizens budget meeting, the insurer was aiming to secure the necessary up to $5.5 billion in risk transfer for a budget that topped-out at $700 million.

At the moment it was above a projection for the place the reinsurance and threat switch spend in premium phrases for full-year 2023 was anticipated to be, which was estimated at $695.2 million.

That was to buy $4.2 billion in safety throughout final yr although, so with the quantity of threat switch required up considerably to $5.5 billion, the rise to a forecast for as much as $700 million to be spent was not stunning.

That $700 million determine was nonetheless being cited at an April assembly of Florida Residents Board. However now, we perceive, the placeholder determine has risen and is being cited for spend for 2024’s threat switch to achieve as much as a most of $750 million.

Fairly the place the elevated cost-expectation has come from is unsure, it might simply be market circumstances or a realisation that the earlier price range was going to show inadequate.

However, with an industry-loss set off cat bond to reset, within the $500m Lightning Re deal that runs for one more couple of years, that might have been a slight contributor given the way in which spreads have moved on these index-trigger cat bonds in current weeks, as we reported earlier today.

After all, Florida Residents reinsurance buying for 2024 is already well-underway, with an up to $1.25 billion catastrophe bond out there alongside a standard reinsurance renewal that’s making progress.

With a price range for as much as $750 million now being requested by employees, it will likely be anticipated to show adequate to safe the entire $5.5 billion reinsurance buy for 2024, which can are available in two foremost layers.

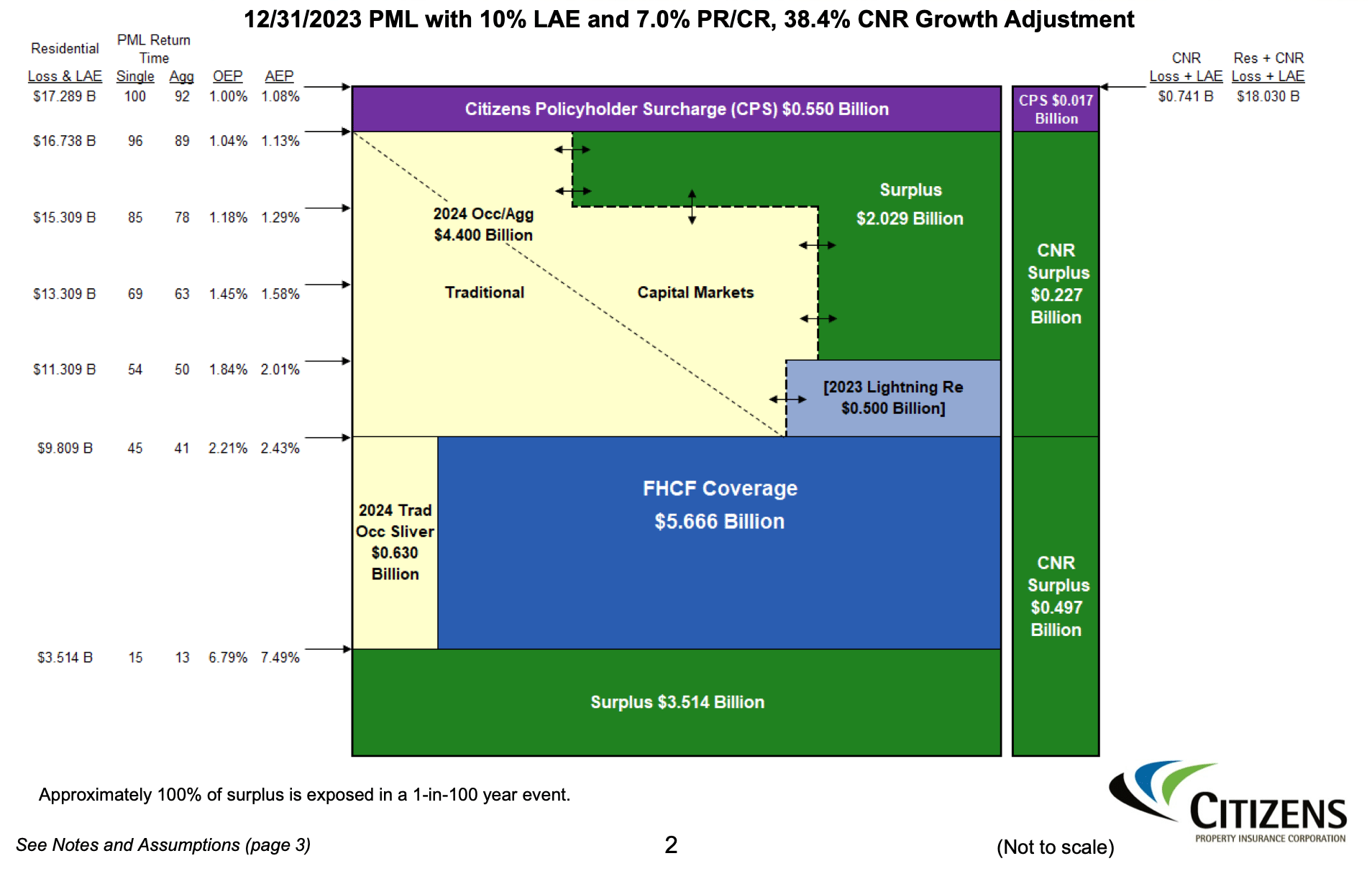

The Florida Residents program will characteristic a sliver layer that sits alongside its FHCF protection, which can present roughly $630 million of per-occurrence one-year cowl, in extra of at attachment level of $3.5 billion, to cowl private residential and business residential losses.

This sliver layer might be positioned within the conventional reinsurance market and is designed to work alongside the necessary protection offered by the FHCF.

In a layer above that, will sit nearly all of Florida Residents personal market threat switch and reinsurance (roughly $4.9 billion value), attaching at $9.8 billion of losses and increasing to $16.7 billion, with reinsurance, disaster bonds and surplus all set to work collectively on this layer.

It’s this layer that the new up to $1.25 billion of Everglades Re II Series 2024-1 catastrophe bond tranches will sit inside, to supply a big chunk of the reinsurance wanted.

Older Everglades cat bond tranches, that had been structured when Residents had a number of accounts, might be matured this yr.

As well as, additionally inside that foremost layer of the 2024 Residents reinsurance tower, the residual market insurer will reset its industry-loss triggered Lightning Re Ltd. (Series 2023-1) disaster bond for the approaching yr.

You’ll be able to see the Florida Residents 2024 reinsurance tower construction under:

.